Table of Content

You can follow the tips given below to improve your eligibility for a home loan. Specifications which the underlying property such as age of the property, its size, etc. Click ‘View Application’ below the one whose status you wish to check. 3) Enter your name, user ID, mobile number and other required details to sign up. IRDAI is not involved in activities like selling insurance policies, announcing bonus or investment of premiums.

If you are planning to avail HDFC Bank home loan, here is all you need to know. Our HDFC Reach Loans make home buying possible for micro-entrepreneurs and salaried individuals who may or may not have sufficient proof of income documentation. You can apply for a house loan with minimal income documentation with HDFC Reach. You can apply for a home loan online from the ease and comfort of your home with HDFC’s online application feature. Alternatively, you can share your contact details here for our loan experts to get in touch with you and take your loan application forward.

Eligibility for HDFC Home Loan for Women

In case, you want to check your eligibility based on your salary you can use the HDFC’s Home Loan eligibility calculator. Once you’ve logged in, you can view/track all information related to your Home Loan including the application status. You can see the application status on the top-right section of the page. Details of ongoing loans of the individual and the business entity including the outstanding amount, instalments, security, purpose, balance loan term, etc. Transferring your outstanding home loan availed from another Bank / Financial Institution to HDFC is known as a balance transfer loan. This option provides you the flexibility to increase the EMIs every year in proportion to the increase in your income which will result in you repaying the loan much faster.

All the information contained herein above is for awareness and customer convenience and is intended to only act as an indicative guide about HDFC’s products and services. For detailed information about HDFC’s products and services kindly visit the nearest HDFC branch. Credit Linked Subsidy Scheme under PMAY makes the home finance affordable as the subsidy provided on the interest component reduces the outflow of the customer on the home loan. The subsidy amount under the scheme largely depends on the category of income that a customer belongs to and the size of the property unit being financed. You can submit a request for the disbursement of your loan online or by visiting any of our offices. Loans against property / Home Equity Loan for Business Purpose i.e.

It helps you avail funds for home purchase

You can go back and modify your inputs if you wish to recalculate your eligibility. These calculators are provided only as general self-help Planning Tools. Results depend on many factors, including the assumptions you provide. We do not guarantee their accuracy, or applicability to your circumstances. I declare that the information I have provided is accurate & complete to the best of my knowledge. I hereby authorize HDFC Ltd. and its affiliates to call, email, send a text through the Short messaging Service and/or Whatsapp me in relation to any of their products.

You can even apply for a home loan whilst you are working abroad, to plan for your return to India in future. Customers will have their HDFC Home Loan EMI due on a fixed date each month. This Bank will notify them the date at the time of loan disbursement. Customers will be required to pay their EMIs throughout the loan tenure till they have paid off their home loan. Knowledge of the home loan EMIs is crucial for calculation of home loan eligibility.

EMI Payable

For home loan approval, you need to submit the following documents for all applicants / co-applicants along with the completed and signed home loan application form. Repayment of home loans is done through Equated Monthly Installments , which is a combination of interest and principal. In the case of loans for resale homes, EMI begins from the month subsequent to the month in which disbursement of the loan is done. In the case of loans for under-construction properties, EMI usually begins once the construction is complete and the house loan is fully disbursed. The EMIs will proportionately increase with every partial disbursement made as per the progress of construction. You can apply for housing loans at any time once you have decided to purchase or construct a property, even if you have not selected the property or the construction has not commenced.

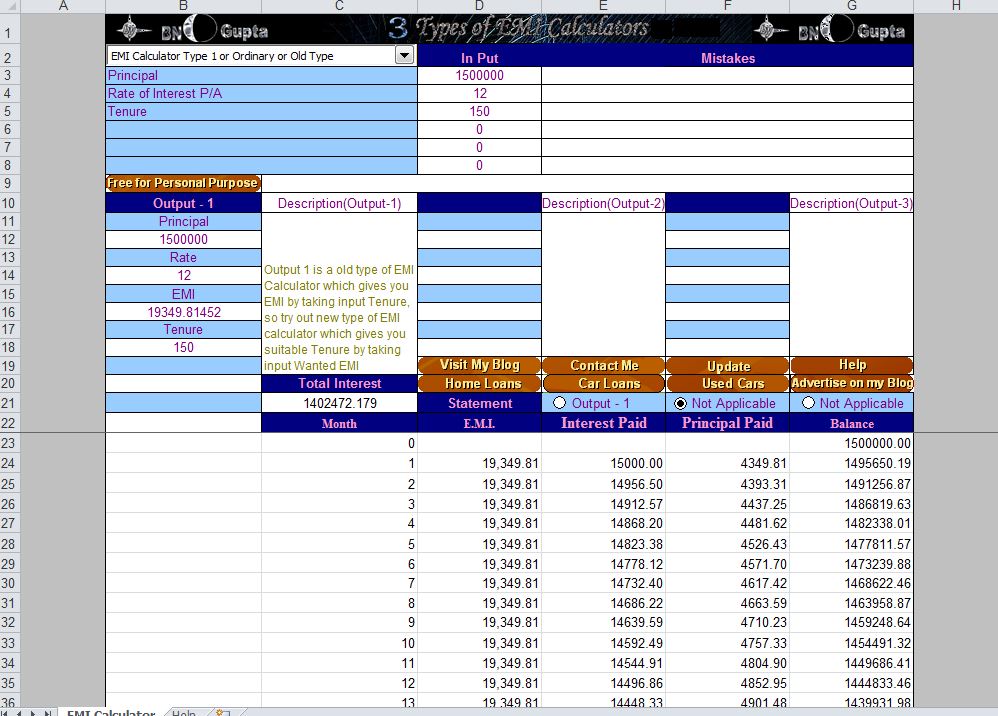

HDFC’s Home Loan EMI calculator makes it easier for the home loan borrowers to calculate and estimate their EMIs for a given loan amount, loan tenure, and interest rate. The minimum and maximum repayment tenure under LoanTap personal loan are 6 to 60 months. Most of the individuals planning to buy their dream property come across the requirement of a home loan.

Magicbricks is a full stack service provider for all real estate needs, with 15+ services including home loans, pay rent, packers and movers, legal assistance, property valuation, and expert advice. As the largest platform for buyers and sellers of property to connect in a transparent manner, Magicbricks has an active base of over 15 lakh property listings. Does HDFC offer a different interest rate for home loan borrowers? Women borrowers are offered home loans at lower interest rates.

All communications will always originate from a verifiable HSPL e-mail address (domains of @hdfcsales.co.in or @hdfcsales.com) and not from any free web based email accounts.

It is best to rectify any such discrepancies well in advance to avoid your HDFC Bank home loan being rejected. Loans for construction on a freehold / lease hold plot or on a plot allotted by a Development Authority. At HDFC, we understand that a home is not just a place to stay. It is a warm little corner in the world that is yours, tailored by your tastes and needs. It is the place where you celebrate the joys and enjoy the journey called life. There is no place like 'home' and with HDFC Home Loans you can gather hopes, achieve your dreams and create memories in your own space.

If you purchase an under construction property you are generally required to service only the interest on the loan amount drawn till the final disbursement of the loan and pay EMIs thereafter. In case you wish to start principal repayment immediately you may opt to tranche the loan and start paying EMIs on the cumulative amounts disbursed. With the help of the HDFC EMI calculator, one can get a clear picture and understanding of the proportion of the principal amount to the interest due that one has to pay. The HDFC Home Loan EMI calculator will also provide a Home Loan Amortization table showing the repayment schedule. Go through the list of documents required and keep them ready before starting your home loan application process.

Home Loan EMI is the monthly repayment that a borrower should make to repay the home loan as per the amortization schedule. HSPL and HSPL authorized recruitment agents/ agencies do not ask for payments from applicants at any point in the recruitment process. You might be working in a company which is not in the list of approved employers by banks. In such cases the banks feel that your job is not secure and not reliable to pay back the loan amount. Look into banks/NBFC that have your company listed to make sure that your application is not rejected and get good terms on your loan.